Normal working time, rest breaks at work in Vietnam

01 Jun, 2020// Group: THE LABOUR CODEThe working hour at night is calculated from 22 pm to 6 am of the following day.

Annual leave in Vietnam

01 Jun, 2020// Group: THE LABOUR CODEAn employee whose period of employment is less than 12 months shall be entitled to annual leave calculated in proportion to the period of employment.

Public holidays in Vietnam

01 Jun, 2020// Group: THE LABOUR CODEThe employees who are foreign citizens working in Vietnam, besides the holidays as prescribed in Clause 1 of this Article, they are also entitled to an additional day of traditional new year

Wage in probationary period in Vietnam

01 Jun, 2020// Group: THE LABOUR CODEDuring the probation period, each party is entitled to cancel the probation agreement without prior notice and without compensation

Is a part-time employee treated less favorably than a full-time employee ?

01 Jun, 2020// Group: THE LABOUR CODELawyers in Vietnam advise about part-time employees

Can an employer unilateral terminate a labor contract prior to its expiry ?

01 Jun, 2020// Group: THE LABOUR CODEWhen unilaterally terminating the labor contract, the employer must notify the employee

Overtime pay in Vietnam

01 Jun, 2020// Group: THE LABOUR CODEAn employee who works at night shall be paid an additional amount at least equal to 30% of the wage calculated by

Recruit and use labor in Vietnam ?

28 May, 2020// Group: THE LABOUR CODEA 100% foreign invested company in Vietnam can recruit staffs in Vietnam ?

Legal service contract for setting up company in Vietnam

27 May, 2020// Group: LAW OFFICE IN VIETNAMLawyer in Vietnam provides legal services for setung up a businesses in Vietnam

Legal service contract in Vietnam

27 May, 2020// Group: LAW OFFICE IN VIETNAMLawyer in Vietnam provides legal outsourcing services for 100% FDI companies in Vietnam

Lawyer in Vietnam

27 May, 2020// Group: LAW OFFICE IN VIETNAMLawyer in Vietnam protects lawful rights, benefits for clients at Court

Bonus, rewards given to employees in Vietnam

27 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSalaries, bonuses, life insurance for employees for which the conditions for entitlement and rates of entitlement are not specified in

Are VAT invoices required for exported goods, services ?

27 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA company shall use VAT invoices for its sales of goods in Vietnam (domestic sales) and not use VAT invoices for exportation

Deduction of input VAT in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESEnterprises, cooperatives buying products from farming, breeding, aquaculture, catching which are not processed into other products or have only been preprocessed

Dutiable objects and declaration of import, export duties in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESThe declaration of duties on imported, exported goods shall be implemented upon occurrence

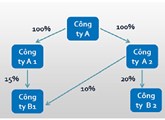

Related party transactions and transfer pricing in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyers in Vietnam advise about setting up a representative office in Vietnam

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax