Regulations to enhance tax administration in e-commerce in Vietnam

Hi DMS Law office in Vietnam! Could you advise me about tax administrative measures to address electronic commerce ?

Hi!

Today, July 01, 2020, the Law on Tax Administration No. 38/2019/QH14, dated June 13, 2019 (hereinafter called “the Law on Tax administration”) comes into effect. There are new regulations to enhance tax administration in e-commerce as follows:

Regulations to enhance tax administration in e-commerce

Commercial banks will be responsible for deducting and paying tax on behalf of foreign enterprises, foreign individuals who conduct e-commerce activities and derive income from Vietnam (Clause 3 Article 27 Law on tax Administration).

With respect to e-commerce activities, business activities based on digital platforms and other services conducted by an overseas supplier without permanent establishments in Vietnam, the overseas supplier must register a tax code, declare and pay tax in Vietnam, either directly or by authorization (Clause 4 Article 42 Law on tax Administration).

When making payment to overseas entities who conduct cross-border business activities based on digital platforms with no presence in Vietnam, the Vietnamese party must withhold, declare and pay tax under the overseas entity’ registered tax code (Clause 6 Article 35 Law on tax Administration).

Related topics:

Are VAT invoices required for exported goods, services ?

Foreign Contractor Tax (FCT) in Vietnam

Deadlines for filing tax returns and deadlines for tax payment in Vietnam

Consulting services:

Phone: 0914 165 703 or Email: dmslawfirm@gmail.com

Regulations to enhance tax administration in e-commerce in Vietnam

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

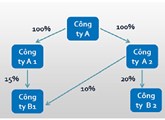

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if