PIT declaration for branches and dependent units in Vietnam ?

A company has its head office in Nha Trang (Khanh Hoa), establishes a branch, a dependent unit in Da Nang city or other provinces, directly pays salaries and wages to employees working at the branch or dependent unit as above, can the company declare and pay personal income tax (PIT) for employees at the tax authority directly managing it ?

DMS Law office in Danang, Vietnam advise about how can the company make PIT declaration for employees working at branches and dependent units ?

Personal income tax (PIT) for income from salaries and wages, from January 1, 2022:

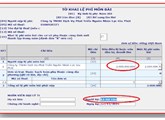

Taxpayers pay salaries and wages to employees working at dependent units or business locations in provinces other than their headquarters, deduct personal income tax on income from salaries and wages according to regulations and submit tax declaration dossiers according to form No. 05/KK-TNCN, the appendix to the table determining the amount of personal income tax payable to localities enjoying revenue sources according to form No. 05-1 /PBT-KK-TNCN promulgated together with Appendix II of this Circular, file to the direct management tax authority; pay personal income tax on incomes from salaries and wages to the state budget for each province where the employee works according to the provisions of Clause 4, Article 12 of this Circular. The personal income tax amount is determined for each province on a monthly or quarterly basis corresponding to the personal income tax declaration period and is not re-determined when finalizing personal income tax (Point a.1 Clause 3 Article 19 of Circular No. 80/2021/TT-BTC dated September 29, 2021.

Therefore, in case the Company has its headquarters in Nha Trang (Khanh Hoa), directly pays salaries and wages to employees working at branches and dependent units in Da Nang city or other provinces, the Company shall submit PIT declaration dossiers for employees in Nha Trang, but must pay the PIT amount for income from salaries and wages to the state budget in Da Nang City or other provinces where employees work as prescribed in Clause 4, Article 12 of Circular No. 80/2021/TT-BTC dated September 29, 2021./.

Contact us:

Phone: 0914 165 703

Email: dmslawfirm@gmail.com

DMS LAW LLC

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

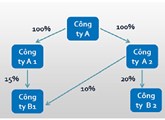

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if