Personal Income Tax (PIT) Finalization for 2020 in Vietnam

DMS Law firm in Danang, Vietnam is launching Personal Income Tax (PIT) Finalization advisory applicable for foreign nationals or Vietnamese who are considered tax residents of Vietnam, earned taxable employment income in 2020 but do not authorize the employers to finalize PIT on their behalf.

Advice on PIT finalization procedures:

If you earned income in 2020 from employment contracts of 03 months or more at two or more sources, you might want to be advised on procedures for your PIT return.

Basic information about PIT finalization in Vietnam:

Taxable income:

For a tax resident of Vietnam, taxable income is income earned both inside and outside the territory of Vietnam, regardless of where such income is paid (Article 1, Circular No. 05/VBHN-BTC, dated 14 March 2016).

Tax residency status:

A tax resident of Vietnam is an individual (a Vietnamese or a foreign national) who meets any of the following conditions:

The person was physically present in Vietnam for 183 days or more during a calendar year or 12 consecutive months from the first date of arrival in Vietnam;

The person has a permanent residential place in accordance with law on residence (Article 1, Circular No. 05/VBHN-BTC, dated 14 March 2016).

Basis for PIT calculation:

The basis for calculating PIT on employment income is the Assessable income and Tax rate (Article 7, Circular No. 05/VBHN-BTC, dated 14 March 2016).

Tax rate:

The rates of personal income tax on income from employment are the progressive rates in Article 22 of the Law on Personal Income Tax, ranging from 5% to 35%.

PIT finalization:

A tax resident who has earned employment income shall be responsible to settle, finalize tax when there is underpaid tax or when there is overpaid tax to be refunded or offset against the next period, except for the cases mentioned in points c.1) to c.6) Clause 2 Article 26, Circular No. 05/VBHN-BTC, dated 14 March 2016./.

Contact us:

Call: 0989 157682

Email: dmslawfirm@gmail.com

DMS Law firm in Vietnam

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

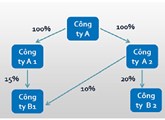

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if