An enterprise lends out its idle cash to other organizations, individuals

Hi DMS Attorney in Vietnam! Can a company lend out its idle cash to other enterprises, individuals to earn interest ? If so, is such interest subjected to VAT ? Shall the company issue invoices for interest received ? Can the borrower claim the interest paid as a deductible expense for CIT purpose ?

Hi!

Goods and services not subjected to VAT:

Separate loans that are not a business and irregularly given by taxpayers that are not credit institutions. Example 5: Joint-stock company C has idle money and signs a contract to give a loan to company T, which is due after 06 months, and receives an interest. Such interest is not subject to VAT (Point b Clause 8 Article 4 Circular No. 14/VBHN-BTC dated May 09, 2018 guiding the implementation of the Law on Value Added Tax and Decree No. 209/2013/ND-CP dated 12/18/2013).

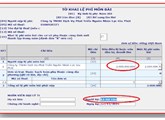

Use of VAT invoices:

Organizations that pay VAT using credit-invoice method selling goods, services not subject to VAT, or exempted from VAT shall use VAT invoices which is only written on the row for “total payment amount”, the rows for “tax rate” and “ VAT amount” are crossed out (Point 2.1 Clause 2 Appendix 4 promulgated together with Circular No. 11/VBHN-BTC dated May 9, 2018 guiding the implementation of Decree No. 51/2010/ND-CP dated May 14, 2010 and Decree No. 04/2014/NĐ-CP dated January 17, 2014).

Deductible and non-deductible expenses for determining taxable income:

Except expenses specified in Clause 2 of this Article, enterprises may deduct all expenses that fully satisfy the following conditions:

Actual expenses arising in relation to production and business activities of enterprises;

Expenses with adequate lawful invoices and documents as required by law;

For expenses for purchase of goods or services with invoices valued at VND 20 million or more (VAT-inclusive prices) each, there must be non- cash payment documents;

Non-cash payment documents must comply with legal documents on value-added tax.

Non-deductible expenses for determining taxable income include:

Interests paid for production and business loans borrowed from subjects other than credit institutions or economic organizations in excess of 150% of the prime interest rate announced by the State Bank of Vietnam at the time of borrowing (Clause 1 and Point 2. 17 Clause 2 Article 6 Circular No. 26/VBHN-BTC dated 09/14/2015 guiding the implementation of Decree No. 218/2013/ND-CP dated 12/26/2013).

In conclusion, in case your company is not a credit institution and has a temporary surplus cash, your company may lend out to other organizations, persons under written agreement to receive interest. Such interest is not subject to VAT. Your company shall issue invoices for interest received, not subject to VAT, the rows for “tax rate” and “Vat amount” shall be crossed out as mentioned in Point 2.1 Clause 2 Appendix 4 promulgated together with Circular No. 11/VBHN-BTC dated May 9, 2018.

Related topics:

Corporate Income Tax (CIT) rates in Vietnam.

Responsibility to submit VAT declaration in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

A company may lend out its idle funds

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Deduction of input VAT in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESEnterprises, cooperatives buying products from farming, breeding, aquaculture, catching which are not processed into other products or have only been preprocessed

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

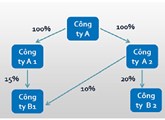

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if