Foreign Contractor Tax (FCT) in Vietnam

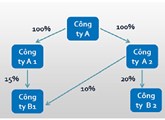

Hi DMS Law office in Vietnam! A foreign company (company A) has signed a general EPC contract with another foreign company (company B). Company B is the investor of a BOT project (Build-Operate-Transfer project) in Vietnam, the foreign company B shall pay the foreign company A by TTR method (Telegraphic Transfer Reimbursement) and L/C (Letter of Credit) from the bank in the country where the foreign company B is located, for works in the general EPC contract implemented by company A. Invoice for goods issued by company A shall be sent to company B’s the bank. Goods shall be delivered by company A to company B at the BOT project’s site in Vietnam. In this case, is the foreign company A required to pay foreign contractor tax (FCT) in Vietnam ?

Hi!

Foreign Contractor Tax (FCT) obligation in Vietnam:

Foreign entities providing goods in Vietnam in the form of domestic export and earn income in Vietnam under contracts between them and Vietnamese companies (except for cases in which goods are processed and then returned to foreign entities) or distribute goods in Vietnam or provide goods under Incoterms rules that require the sellers to be responsible for goods that have been taken into Vietnam’s territory (Clause 2 Article 1 Circular No. 103/2014/TT-BTC dated August 6, 2014).

Therefore, in case the foreign company A distributes goods in Vietnam or provides goods under Incoterms rules that require the sellers to be responsible for goods that have been taken into Vietnam’s territory, company A shall subject to Foreign Contractor Tax (FCT) in Vietnam.

In case the foreign company B implements BOT projects in Vietnam, in the form of setting up a company in Vietnam (the Vietnamese company) in accordance with the Law on Investment, such Vietnamese company signs contract to import machinery, equipment with the foreign company B or other foreign company (company A) in which goods are delivered at Vietnam’s border checkpoint without ancillary services in Vietnam, then the foreign company B or the foreign company A shall not subject to foreign contractor tax (FCT) in Vietnam (Clauses 1, 2 Article 2 Circular No. 103/2014/TT-BTC dated August 6, 2014).

Related topics:

Corporate Income Tax (CIT) rates in Vietnam.

Responsibility to submit VAT declaration in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

Foreign Contractor Tax (FCT) in Vietnam

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if

Filing frequencies for VAT returns in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyers in Vietnam advise about enterprise income tax incentives in Vietnam

Responsibility to submit VAT declaration in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESWhere do we submit tax declaration files if the taxpayer has dependent units located in the same province, in a different province ?

Deadlines for filing tax returns and deadlines for tax payment in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESTime-limit to submit tax returns and deadline to pay tax bills in Vietnam

Corporate Income Tax exemption and reduction in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESThe tax exemption or reduction duration specified in this Article shall be counted consecutively from the first year an enterprise has taxable income from a new investment project