Financial policies for FDI companies in Vietnam

DMS Law firm in Danang, Viet Nam is providing professional service to develop internal financial policies for FDI companies in Vietnam.

According to OECD (Investment Policy Reviews: Viet Nam 2018), recent regulatory changes are likely to facilitate cross-border M&A activity in Viet Nam. Also, much of the Foreign Direct Investment (FDI) in Viet Nam has come from Asia, suggesting that there is still substantial scope for investors from Europe and North America to present in Viet Nam. Increase of foreign direct investment and M&A activities would accompany the presence of FDI companies, multinational enterprises (MNEs) in Viet Nam, and the need to adopt good corporate governance practice, especially in MNEs whose home countries are Europe and America.

Constructing and adopting an internal financial policy is a good corporate governance practice, especially in FDI companies, MNEs. An internal financial policy shall clarify the authority and responsibility for making financial decisions and increase transparency. A well-constructed internal financial policy should help company’s staff and board members to carry out financial management activities efficiently and lawfully. Internal financial policies should encompass areas such as: authority and order for approval of financial transactions and making decisions, policy on conflicts of interest or insider transactions, safeguarding of company’s assets, prevention and detection of frauds and errors, responsibility for maintaining financial records, timely preparation of reliable financial information, compliance with laws and regulations in the host country, Viet Nam.

With our experts in laws, accounting, finance and tax advisory, DMS Law firm in Danang, Vietnam is providing professional service to develop internal financial policies for FDI companies in Viet Nam./.

Contact us:

Call: 0989165703

Email: dmslawfirm@gmail.com

DMS Law firm in Vietnam

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

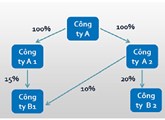

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if