Filing frequencies for VAT returns in Vietnam

Hi DMS Attorney in Vietnam! Could you advise me about the frequency to declare VAT ? The taxpayer that has just begun his business shall declare VAT quarterly. In the next calendar year after 12 months of business, VAT declarations shall be declared whether monthly or quarterly depending on.

Hi!

Declaring VAT in Vietnam:

VAT declarations shall be declared monthly, except for the cases in Points b, c, and d of this Clause.

Quarterly declaration of VAT:

The taxpayers eligible to declare VAT quarterly:

The taxpayer earns a total revenue of 20 billion VND or less from the sale of goods and/or services in the preceding year.

The taxpayer that has just begun his business shall declare VAT quarterly. In the next calendar year after 12 months of business, VAT declarations shall be declared whether monthly or quarterly depending on the revenue from the sale of goods and/or services in the preceding calendar year (12 months).

Method of determining revenue from sale of goods and services in the preceding year (to determine the eligibility to declare VAT quarterly):

The revenue from sale of goods and services is the total of revenues in the VAT declarations in the calendar year (including taxable and non-taxable revenues).

Where the taxpayer declares tax at the head office on behalf of their affiliates, the revenue from sale of goods and services include the revenues earned by their affiliates.

VAT shall be provisionally declared upon occurrence for construction business, installation, irregular sales, property transfer out-of-province

VAT on revenues of casual businesspeople shall be declared upon occurrence, using the direct method.

Period of quarterly declaration: VAT shall be declared monthly or quarterly throughout the calendar year and throughout the 3-year period (Clause 2 Article 11, Circular 15/VBHN-BTC dated May 09, 2018).

Related topics:

Responsibility to submit VAT declaration in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

The frequency of VAT reporting in Vietnam

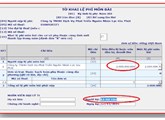

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Deduction of input VAT in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESEnterprises, cooperatives buying products from farming, breeding, aquaculture, catching which are not processed into other products or have only been preprocessed

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions