Deadlines for filing tax returns and deadlines for tax payment in Vietnam

Hi DMS Attorney in Vietnam! Could you advise me about time-limit to submit tax returns and deadline to pay tax bills ?

Hi!

Deadlines for submitting tax declarations:

The deadline for submitting a monthly tax declaration is the 20th of the month succeeding the month in which tax is incurred.

The deadline for submitting a quarterly tax declaration or provisional quarterly tax declaration is the 30th of the quarter succeeding the quarter in which tax is incurred.

The annual tax declaration must be submitted by the 30th of the first month of the calendar year.

The deadline for submitting an unscheduled tax declaration (upon incurrence of tax) is the 10th day following the day on which tax is incurred.

The deadline for submitting a yearly tax finalization is the 90th day immediately following the end of the calendar year or fiscal year.

The deadline for submitting a tax finalization when the company is split, spin-off, consolidated, merged, transformed, dissolved, or shut down is the 45th day following the day on which a decision on such split-up, spin-off consolidation, merger, transformation, dissolution, or shut down is made (Clause 3 Article 10 Circular No. 15/VBHN-BTC dated May 09, 2018)

Some changes to the deadlines for filing tax declarations:

According to Article 44, Law on Tax Administration No. 38/2019/QH14, dated June 13, 2019, will take effect from July 01, 2020:

The deadline for submitting a monthly tax declaration is the 20th of the month succeeding the month in which tax is incurred.

The deadline for submitting a quarterly tax declaration or provisional quarterly tax declaration is the last day of the first month of the quarter succeeding the quarter in which tax is incurred.

The deadline for submitting a yearly tax finalization is the last day of the third month immediately following the end of the preceding calendar year or fiscal year.

The deadline for submitting a yearly personal tax finalization of individuals directly finalizing their tax is the last day of the fourth month immediately following the end of the preceding calendar year (i.e. 30 April of the next calendar year).

The deadline for submitting a tax declaration of a business household or s business person that pays tax under the presumptive method is the 15th December of the preceding calendar year.

The deadline for submitting an unscheduled tax declaration (upon incurrence of tax) is the 10th day following the day on which tax is incurred.

The deadline for submitting a tax declaration in cases of termination of operation, termination of contract or corporate reorganization shall not be later than the 45th day following such event.

Time-limits for tax payment in Vietnam:

Where a taxpayer calculates an amount of tax payable, the deadline for tax payment shall be the last day of the time-limit for submitting a tax declaration file.

Where the tax management body calculates or fixes an amount of tax payable, the time-limit for tax payment shall be stated in the notice sent by the tax management body (Clauses 1, 2 Article 42 Law on Tax Administration No. 78/2006/QH11)

Some changes to the time-limits for tax payment in Vietnam:

According to Clauses 1, 2 Article 55, Law on Tax Administration No. 38/2019/QH14, dated June 13, 2019, will take effect from July 01, 2020:

Where a taxpayer calculates an amount of tax payable, the deadline for tax payment shall be the last day of the time-limit for submitting a tax declaration file. In cases of an amended tax declaration, the deadline for tax payment is the deadline for tax declaration of the period in which the errors occurred.

The deadline for tax payment of provisional quarterly Corporate Income Tax (CIT) is the 30th of the first month of the next quarter.

Where the tax management body calculates or fixes an amount of tax payable, the time-limit for tax payment shall be stated in the notice sent by the tax management body.

Related topics:

Responsibility to submit VAT declaration in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

Deadlines for filing tax returns and deadlines for tax payment in Vietnam

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

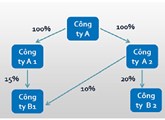

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if

Foreign Contractor Tax (FCT) in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESDistribute goods in Vietnam or provide goods under Incoterms rules that require the sellers to be responsible for goods that have been taken into Vietnam’s territory

Filing frequencies for VAT returns in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyers in Vietnam advise about enterprise income tax incentives in Vietnam

Responsibility to submit VAT declaration in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESWhere do we submit tax declaration files if the taxpayer has dependent units located in the same province, in a different province ?

Corporate Income Tax exemption and reduction in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESThe tax exemption or reduction duration specified in this Article shall be counted consecutively from the first year an enterprise has taxable income from a new investment project