Conditions for input VAT deduction

Hi DMS Law office in Vietnam! Could you advise me conditions for input VAT deduction ?

Hi!

Conditions for input VAT deduction

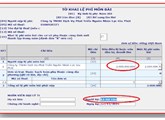

Have legitimate VAT invoices for purchases or receipts for payment of VAT on imported goods, or receipts for payment of VAT on behalf of foreign entities in accordance with guidelines of the Ministry of Finance applicable to foreign organizations that do not have Vietnamese legal status and foreign individuals that do business or earn income in Vietnam.

Have receipts for non-cash payments for the purchases (including imported goods) that cost VND 20 million or more inclusive of VAT, except for purchases that cost below VND 20 million inclusive of VAT for each time of purchase and for business establishments that import goods which are gifts, donations given by foreign organizations, foreign individuals. Receipts for non-cash payments include bank transfer receipts and other receipts for non-cash payments prescribed in Clause 3 and Clause 4 of this Article.

When multiple purchases bought from the same provider in the same day, each of which costs below VND 20 million but the total aggregate value is VND 20 million or more, tax shall only be deducted if bank transfer receipts are presented. The supplier is a taxpayer that has a tax code, directly declares and pays VAT (Clauses 1, 2, 5 Article 15 Circular No.14/VBHN-BTC dated May 09, 2018).

Related topics:

Differences in tax position of individual investors in Vietnam

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

Conditions for input VAT deduction

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Deduction of input VAT in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESEnterprises, cooperatives buying products from farming, breeding, aquaculture, catching which are not processed into other products or have only been preprocessed

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions