Chief Accountant is a statutory position of companies in Vietnam

The Vietnamese Accounting Law requires the legal representatives of companies to employ an in-house Chief Accountant or to hire an outsourced Chief Accountant.

DMS Lawyers in Danang, Vietnam advise about Chief Accountant is the head of the accounting function of a company, responsible for organizing and performing the accounting work in the accounting unit ?

Payment vouchers, payment orders must be signed by the person who has the competent to approve expenditures and the Chief Accountant before implementation.

The chief accountant must have the following criteria and conditions:

- Have professional ethics, honesty, integrity and a sense of law observance;

- Possess a professional qualification in accounting;

- Have professional knowledge in accounting from intermediate level or higher;

- Have a certificate of training for Chief Accountant;

- Have actually worked in accounting for at least 02 years for people with a Bachelor Degree in accounting or higher, at least 03 years for people with accounting expertise at intermediate and college levels

The chief accountant has the following responsibilities:

- Implement the provisions of the law on accounting and finance in the accounting function;

- Organize and administer the accounting function in accordance with this Law;

- Prepare financial statements in compliance with accounting regimes and accounting standards.

Legal base:

Accounting Law No. 88/2015/QH13 dated 20 November 2015.

Consulting services:

Consultants for Corporate Accounting, Tax reporting and Compliance services: Ms. Thi-Ha Nguyen, ACCA./.

Contact us:

Mobile: (+ 84) 989 157 682

Email: dmslawfirm@gmail.com

DMS LAW LLC

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

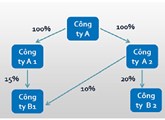

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if