Can the profits from real estate transfer be offset with losses from business activities ?

In case, when finalizing corporate income tax (CIT) in 2021, can enterprises offset profits from business activities with losses of real estate transfer, project transfer, investment, transfer the right to participate in the implementation of investment projects ?

DMS Lawyers in Danang, Vietnam advise on how can the profits from real estate transfer be offset with losses from business activities ?

Taxable income:

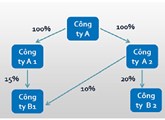

Income from real estate transfer, investment project transfer, transfer of the right to participate in investment projects: must be accounted separately for corporate income tax declaration and payment (from January 1, 2016, the CIT rate is 20%), is not entitled to income tax incentives;

Enterprises in the tax period that suffer a loss from real estate transfer, investment project transfer, transfer of the right to participate in the implementation of investment projects (except for mineral exploration and mining projects), such loss is offset against the profit from production and business activities (including other incomes specified in Article 7 of Circular No. 78/2014/TT-BTC); after offsetting, the remaining loss is carried forward to the following years within the time limit for carrying forward losses as prescribed (Article 2 of Circular No. 96/2015/TT-BTC dated June 22, 2015).

Based on the above legal provisions, only in the case of enterprises in the tax period suffering losses from real estate transfer activities, those losses shall be offset against the profits of production and business activities, there is no regulation on the opposite (vice versa), thus in case the enterprise has a profit from real estate transfer, this profit shall not be offset against the loss of business activities;

Therefore, when finalizing CIT in 2021, if the enterprise makes a profit from the transfer of real estate, the transfer of investment projects, the transfer of the right to participate in the implementation of investment projects, it cannot be offset against a loss of business activities, but must be declared and paid CIT of real estate transfer activities./.

Contact us:

Phone: 0914 165 703

Email: dmslawfirm@gmail.com

DMS LAW LLC

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if