Are VAT invoices required for exported goods, services ?

Hi DMS Attorney in Vietnam! My company is using the credit-invoice method to declare VAT. Could you advise me about use of VAT invoices ? Are VAT invoices required for exported goods, services ?

Hi!

VAT invoices:

VAT invoices (template 3.1 in Appendix 3 and template 5.1 in Appendix 5 enclosed herewith) are invoices used by organizations that declare and calculate VAT using the credit-invoice method for:

Domestic goods sale and service provision;

International transport;

Export of goods to free trade zones and other cases considered export.

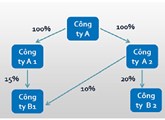

Example:

Company A is a company that declares VAT using the credit-invoice method, sells goods in Vietnam and export goods. Company A shall use VAT invoices for its sales of goods in Vietnam (domestic sales) and not use VAT invoices for exportation (Clause 1 Article 5 Circular No. 119/2014/TT-BTC dated 08/25/2014).

Therefore, the enterprise shall not issue VAT invoices for exported goods./.

Legal bases:

Clause 2 Article 3, Clause 3 Article 32 Circular No. 39/2014/TT-BTC dated 03/31/2014;

Official Correspondence No. 7924/BTC-TCHQ dated 06/16/2014;

Official Correspondence No. 11352/BTC-TCHQ dated 08/14/2014;

Clause 1 Article 5 Circular No. 119/2014/TT-BTC dated 08/25/2014.

Related topics:

Filing frequencies for VAT returns in Vietnam

Responsibility to submit VAT declaration in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

Deduction of input VAT in Vietnam

.

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if