Allocation of Personal Income Tax on income from salaries and wages

DMS Law firm in Danang, Vietnam advise about new regulations about Personal Income Tax (PIT) on income from salaries and wages in Vietnam ?

From January 1, 2022, taxpayers are required to allocate Personal Income Tax (PIT) if they withhold PIT on income from salaries and wages paid at the head office to employees working at dependent units or business locations in other provinces.

Taxpayers separately determine the PIT amount that must be allocated to incomes from salaries and wages of individuals working in each province according to the actual tax withheld of each individual. In case the employee is transferred, rotated or seconded, based on the time of income payment and which province the employee is working in, the amount of PIT withheld shall be calculated for that province.

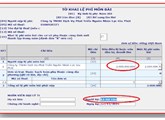

Taxpayers pay salaries and wages to employees working at dependent units or business locations in provinces other than the head office, deduct Personal Income Tax on income from salaries and wages according to regulations and submit tax declaration dossiers according to form No. 05/KK-TNCN, appendix to determine the amount of PIT payable to localities enjoying revenue sources according to form No. 05-1 /PBT-KK-TNCN promulgated together with Appendix II of this Circular for the tax authority in charge; pay PIT to the state budget for each province where the employee works according to the provisions of Clause 4, Article 12 of this Circular. The Personal Income Tax amount is determined for each province on a monthly or quarterly basis corresponding to the PIT declaration period and is not re-determined when finalizing PIT./.

Legal base:

Circular 80/2021/TT-BTC issued on September 29, 2021 by the Ministry of Finance.

Contact us:

Call: +84 989 157 682

Email: dmslawfirm@gmail.com

DMS Law firm in Vietnam

Director

(Signed)

Lawyer Do Minh Son

RELATING ITEMS

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

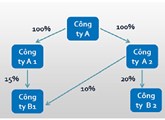

VAT for intra-company transactions between a company and a branch

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if