Conditions for deducting and refunding input VAT on exported goods and services

Hi DMS Law office in Vietnam! Could you advise me on conditions for deducting and refunding input VAT on exported goods and services ?

Hi!

Conditions for deducting and refunding input VAT on exported goods and services in Vietnam:

Input VAT on goods and services (except for cases mentioned in Article 17 of this Circular) shall only be deducted and refunded if the conditions and procedures mentioned in Clause 2 Article 9 and Clause 1 Article 15 of this Circular.

Summary of specific conditions:

Have an agreement on the purchase of goods, services, or agreement on goods processing for foreign organizations, foreign individuals;

Have a customs declaration form for exported goods if customs procedure has been completed in accordance with instructions of the Ministry of Finance;

If the taxpayer exports software programs in the form of physical packages, the customs declaration must be made similarly to ordinary goods in order to deduct input VAT;

The customs declaration is not required in the following cases:

A business establishment that exports software, services via electronic means is not required to have a customs declaration form. The business establishment must carry out procedures to confirm that the buyers have received the services, software exported via the via electronic means according to law on e-commerce.

The construction or installation executed overseas or in free trade zones.

Supply of electricity, water, stationery, and goods serving every day life of export processing companies, comprising of foods, consumables (including personal protective equipments).

Payments for exported goods and services must be made by bank transfers.

Legal basis: Article 16 Article 15 Circular No.14/VBHN-BTC dated May 09, 2018

Related topics:

Differences in tax position of individual investors in Vietnam

Conditions for input VAT deduction

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

Conditions for deducting and refunding input VAT on exported goods and services in Vietnam

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

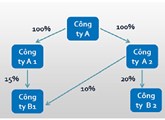

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Group: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if

Foreign Contractor Tax (FCT) in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESDistribute goods in Vietnam or provide goods under Incoterms rules that require the sellers to be responsible for goods that have been taken into Vietnam’s territory

Filing frequencies for VAT returns in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESLawyers in Vietnam advise about enterprise income tax incentives in Vietnam

Responsibility to submit VAT declaration in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESWhere do we submit tax declaration files if the taxpayer has dependent units located in the same province, in a different province ?

Deadlines for filing tax returns and deadlines for tax payment in Vietnam

25 May, 2020// Group: LAW ON ACCOUNTING AND TAXESTime-limit to submit tax returns and deadline to pay tax bills in Vietnam