Withholding tax on goods and services purchased from overseas suppliers

25 Nov, 2021// Category: LAW ON ACCOUNTING AND TAXESTax management for e-commerce, digital-based business and other services of foreign suppliers

Chief Accountant is a statutory position of companies in Vietnam

19 Jul, 2021// Category: LAW ON ACCOUNTING AND TAXESCompanies in Vietnam are required to appoint a Chief Accountant or to hire an outsourced Chief Accountant

CPA Conversion test in Vietnam

13 Jul, 2021// Category: LAW ON ACCOUNTING AND TAXESCPA Vietnam Conversion exam applies for ACCA, CPA Australia and ICAEW Chartered Accountants

Personal Income Tax (PIT) Finalization for 2020 in Vietnam

09 Sep, 2020// Category: LAW ON ACCOUNTING AND TAXESPIT return for 2020 - Advisory services for Personal Income Tax (PIT) Finalization for 2020 in Vietnam

Financial policies for FDI companies in Vietnam

09 Sep, 2020// Category: LAW ON ACCOUNTING AND TAXESAdvisory service to develop internal financial policies for FDI companies in Vietnam

Payroll policies for FDI companies

09 Sep, 2020// Category: LAW ON ACCOUNTING AND TAXESAdvisory service to design, formulate payroll policies for FDI companies

Regulations to enhance tax administration in e-commerce in Vietnam

03 Jul, 2020// Category: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about new regulations to enhance tax administration in e-commerce

Fulfillment of tax liability before exiting Vietnam

03 Jul, 2020// Category: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about responsibility to settle tax before leaving Vietnam

Are VAT invoices required for exported goods, services ?

27 May, 2020// Category: LAW ON ACCOUNTING AND TAXESA company shall use VAT invoices for its sales of goods in Vietnam (domestic sales) and not use VAT invoices for exportation

Bonus, rewards given to employees in Vietnam

27 May, 2020// Category: LAW ON ACCOUNTING AND TAXESSalaries, bonuses, life insurance for employees for which the conditions for entitlement and rates of entitlement are not specified in

Can a company deduct office rents paid to an individual landlord ?

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESIn case an enterprise leases assets from an individual and there is an agreement in the lease contract that the rent is exclusive of tax

VAT for intra-company transactions between a company and a branch

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESLawyer in Vietnam advises about VAT for intra-company transactions between a company and a branch

Declaration and payment of Business license fee in Vietnam

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESExemption of business license fee in the first year of establishment or doing business (from January 01 to December 31) is applicable to

An enterprise lends out its idle cash to other organizations, individuals

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESSeparate loans that are not a business and irregularly given by taxpayers that are not credit institutions

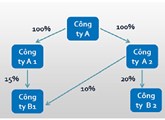

Cases exempted from declaring, preparing transfer pricing documentation

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESA taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if

Related party transactions and transfer pricing in Vietnam

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESLawyers in Vietnam advise about setting up a representative office in Vietnam

Dutiable objects and declaration of import, export duties in Vietnam

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESThe declaration of duties on imported, exported goods shall be implemented upon occurrence

Deduction of input VAT in Vietnam

26 May, 2020// Category: LAW ON ACCOUNTING AND TAXESEnterprises, cooperatives buying products from farming, breeding, aquaculture, catching which are not processed into other products or have only been preprocessed