Cases exempted from declaring, preparing transfer pricing documentation

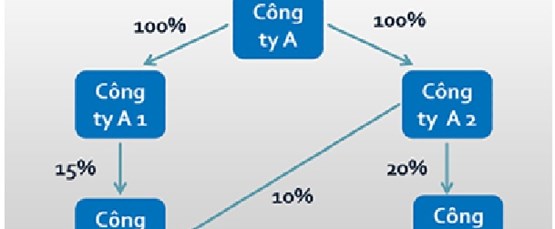

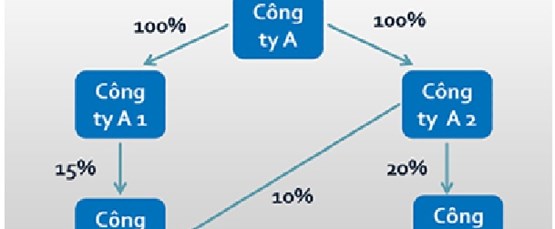

Hi DMS Lawyer in Vietnam! An enterprise, an investor may buy shares of capital contribution, shares of other companies. These companies may have related-party relationships. Several companies may have multiple purchases, related party transactions with each other. Could you advise me about provisions of law on tax administration in respect of cases in which a taxpayer shall be exempted from declaring, preparing the transfer pricing documentation ?

Hi!

Cases in which a taxpayer shall be exempted from declaring, preparing transfer pricing documentation:

A taxpayer shall be exempted from declaring, preparing the transfer pricing documentation referred to in Sections III and IV of the Form 01 given in the Appendix to this Decree only if it is engaged in a related-party transaction with entities that pay corporate income tax within the territory of Vietnam, are subject to the same corporate income tax rate as applied to the taxpayer, and where neither of them is offered the corporate income tax incentives within a specified tax period, but shall be required to declare bases for such exemption in Sections I, II included in the Form No.01 of the Appendix to this Decree.

The taxpayer shall be responsible for declaration of transfer pricing information according to the Form No.01 given in the Appendix to this Decree but shall be exempted from preparing the transfer pricing documentation in the following circumstances:

A taxpayer is engaged in related-party transactions but the total revenue arising within a specified tax period is less than VND 50 billion and the total value of the related-party transactions arising within a specified tax period does not exceed VND 30 billion;

A taxpayer already entering into Advance Pricing Agreement (APA) has submitted the annual report in accordance with legislation on Advance Pricing Agreement. For those related party transactions which are not covered by the APA, the taxpayer is obliged to comply with the aforesaid declaring, preparing the transfer pricing documentation referred to in Article 10 hereof;

Taxpayers performing business activities by exercising routine functions, neither generating any revenue nor incurring any cost from operation or use of intangible assets, generating sales of less than VND 200 billion, as well as applying the ratio of net operating profit before interest and tax (PBIT) relative to sales revenue, engages in related-party transactions in the following sectors:

- Distribution: 5% or more;

- Manufacturing: 10% or more;

- Outsourcing: 15% or more.

Where taxpayers do not comply with the net profit margins stipulated in this point, the aforesaid transfer pricing documentation shall be required (Article 11 Decree No. 20/2017/ND-CP dated 02/24/2017).

Related topics:

Corporate Income Tax (CIT) rates in Vietnam.

Corporate Income Tax (CIT) rates in Vietnam

Corporate Income Tax exemption and reduction in Vietnam

Consulting services:

Phone: 0914 165 703 or email: dmslawfirm@gmail.com

A company may lend out its idle funds

| Prepared by: Thi-Ha Nguyen, ACCA | DMS Law firm in Vietnam Director (Signed) Lawyer Do Minh Son |

RELATING ITEMS

Can the profits from real estate transfer be offset with losses from business activities ?

02 Apr, 2022// Group: LAW ON ACCOUNTING AND TAXESIs it possible to offset profits from production and business activities with losses from real estate transfer?

Subject to related-party transactions in Vietnam ?

02 Apr, 2022// Group: LAW ON ACCOUNTING AND TAXESEnterprises under the control of an individual through capital contribution have buying and selling transactions?

Fiscal and monetary policies to support enterprises in year 2022

08 Feb, 2022// Group: LAW ON ACCOUNTING AND TAXESVAT rate is cut down from 10 percent (10%) to 8 percent (8%), except for certain goods and services

Allocation of Personal Income Tax on income from salaries and wages

25 Nov, 2021// Group: LAW ON ACCOUNTING AND TAXESNew regulations about Personal Income Tax (PIT) on income from salaries and wages in Vietnam

Allocate Value-Added Tax payable to provinces where the production facility is located

25 Nov, 2021// Group: LAW ON ACCOUNTING AND TAXESA taxpayer must allocate the VAT payable to provinces where the production facility is located